The hum of the data center, a symphony of computational power, is the soundtrack of the modern gold rush. Forget picks and shovels; today’s prospectors wield Application-Specific Integrated Circuits (ASICs), specialized hardware designed for one singular, computationally intensive task: mining cryptocurrency. And when it comes to Bitcoin, the USA is becoming a significant player in the ASIC mining equipment arena, offering machines that promise high performance and, crucially, energy efficiency.

Bitcoin, the grandfather of cryptocurrency, remains the most sought-after digital asset, its value underpinned by its decentralized nature and limited supply. But securing that Bitcoin requires solving complex mathematical problems, a process known as proof-of-work. This is where ASIC miners enter the picture. Unlike general-purpose computers, ASICs are optimized for the SHA-256 algorithm, the cryptographic hash function used by the Bitcoin network. This specialization allows them to perform calculations exponentially faster than CPUs or GPUs, making them the essential tool for competitive Bitcoin mining.

However, the immense computational power of ASIC miners comes at a cost: energy consumption. Mining is an energy-intensive process, and inefficient mining rigs can quickly erode profitability. That’s why serious Bitcoin enthusiasts are increasingly focused on acquiring ASICs that deliver the highest hash rate per watt. American manufacturers are stepping up to meet this demand, innovating with designs that prioritize both performance and energy efficiency.

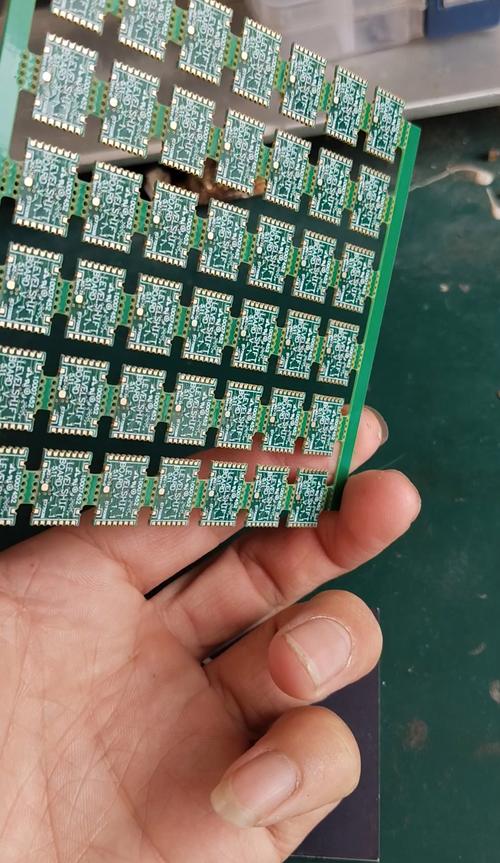

The rise of ASIC mining has fundamentally altered the landscape of cryptocurrency mining. Early adopters could mine Bitcoin using their home computers, but as the network’s difficulty increased, specialized hardware became a necessity. Today, mining is largely concentrated in large-scale data centers, often located in regions with access to cheap electricity. These “mining farms” house hundreds or even thousands of ASIC miners, all working in unison to solve blocks and earn Bitcoin rewards.

Beyond Bitcoin, the ASIC landscape is evolving to accommodate other cryptocurrencies. While Bitcoin is the primary target, some ASICs are designed to mine other SHA-256 coins, allowing miners to switch between currencies based on profitability. However, the core principle remains the same: specialized hardware optimized for maximum hash rate and energy efficiency.

The decision to invest in ASIC mining equipment is a significant one, requiring careful consideration of factors such as initial cost, electricity rates, cooling infrastructure, and network difficulty. Furthermore, the cryptocurrency market is notoriously volatile, and the profitability of mining can fluctuate dramatically based on price swings. Aspiring miners must conduct thorough research and develop a comprehensive business plan before diving in.

One approach to Bitcoin mining that mitigates some of these risks is mining machine hosting. Instead of purchasing and operating their own equipment, individuals can lease space in a data center and have their ASICs managed by professionals. This eliminates the need for specialized infrastructure and technical expertise, allowing miners to focus on maximizing their returns.

Exchanges play a crucial role in the entire cryptocurrency ecosystem, providing the platform for buying, selling, and trading digital assets. The price of Bitcoin, as determined by these exchanges, directly impacts the profitability of mining. Miners sell their earned Bitcoin on exchanges to cover their operating costs and generate profit, creating a direct link between the mining industry and the broader cryptocurrency market.

The future of ASIC mining is likely to be characterized by even greater specialization and energy efficiency. As the Bitcoin network continues to grow and evolve, the demand for high-performance mining equipment will only increase. American manufacturers are well-positioned to lead the way, developing innovative ASICs that push the boundaries of computational power while minimizing energy consumption. For serious Bitcoin enthusiasts, investing in USA-made ASIC mining equipment represents a commitment to the long-term viability and security of the Bitcoin network.

This article delves into the cutting-edge ASIC mining gear from the USA, highlighting remarkable energy efficiency alongside unparalleled performance. It explores how serious Bitcoin miners can leverage advanced technology to maximize returns while minimizing environmental impact, blending innovation with sustainability in crypto mining.