In the ever-evolving landscape of cryptocurrency, the quest for the most cost-effective mining strategy is relentless, especially in South Korea where electricity rates, regulatory frameworks, and technological advancements intersect uniquely. Choosing the right mining machines for Bitcoin mining here isn’t just about raw power; it’s a balancing act involving efficiency, upfront investment, and ongoing operational expenses. With Bitcoin’s soaring popularity and market volatility, miners must weigh every factor carefully to ensure profitability while maintaining sustainability in this competitive ecosystem.

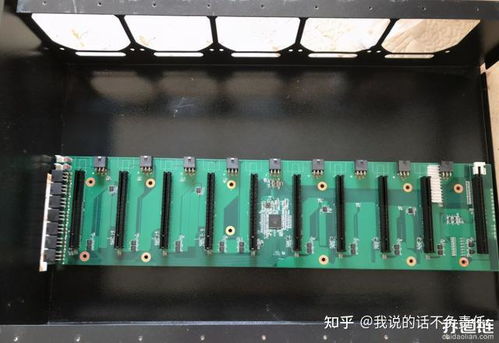

Firstly, understanding the fundamental role of mining rigs is crucial. Mining rigs, essentially highly specialized computers, solve complex cryptographic puzzles to validate transactions on the Bitcoin blockchain. The process is energy-intensive and requires machines optimized for maximum hash rates — the speed at which they can process data — while conserving as much energy as possible. South Korea, with its technological infrastructure and comparatively high electricity costs, demands miners to prioritize energy efficiency alongside computational power.

Popular Bitcoin mining machines like the Antminer series by Bitmain or MicroBT’s Whatsminer are often the first choices due to their high hash rates ranging from 80 to over 110 terahashes per second (TH/s). However, their power consumption also fluctuates between 2,500 to 3,500 watts, which directly impacts operational costs. When selecting equipment, miners in South Korea must analyze watt-per-terahash ratios to maximize profitability. This ratio reveals how many watts of electricity are consumed to deliver one terahash of computing power. A lower ratio typically means more efficient hardware.

The importance of hosting mining machines cannot be overstated in South Korea’s competitive market. Mining farms and hosting services provide specialized environments optimized for cooling, stable electricity supply, and maintenance, which individual miners might find challenging to manage. Using hosting services allows miners to avoid the pitfalls of fluctuating energy prices and local regulations, by essentially outsourcing the energy cost management and infrastructure headaches. In regions with inconsistent weather or grid reliability issues, these hosted solutions can deliver consistent hash rates and uptime, directly affecting profit margins.

While Bitcoin dominates the mining landscape, diversifying into other cryptocurrencies like Ethereum (ETH) or Dogecoin (DOG) can sometimes offset volatility in Bitcoin’s price. Ethereum mining utilizes a different consensus mechanism and generally requires GPUs rather than ASIC-based machines. For miners considering broadening their portfolio, selecting equipment compatible or specialized for multiple coins can add resilience to their overall operation. However, Bitcoin-specific ASIC miners usually outperform GPU rigs in power and hash efficiency, reinforcing Bitcoin’s supremacy in high-scale mining operations.

Exchanges and the broader ecosystem also play a pivotal role. Choosing the right cryptocurrency exchange to liquidate mined coins impacts profitability post-mining. South Korean exchanges such as Upbit and Bithumb offer robust platforms for trading Bitcoin and other cryptocurrencies, but their fee structures, liquidity, and withdrawal limits must be factored into the overall mining strategy. Integrating mining activities with real-time market analytics enables miners to time sales strategically, amplifying margins or mitigating losses during bearish phases.

Mining farms that unleash economies of scale often invest in the newest ASIC miners to stay ahead, constantly upgrading to machines featuring improved energy efficiency and hash rates. For instance, the latest generation ASIC miners have slashed power consumption by nearly 30% compared to models from just a year ago, highlighting the technology race’s rapid pace. South Korean miners should monitor this evolution closely, balancing the timing of hardware upgrades against depreciation and depreciation curves typical in mining machinery.

Moreover, environmental concerns and regulations in South Korea have begun influencing the mining landscape. The government has shown interest in promoting cleaner, renewable energy sources for mining activities, nudging operators toward sustainable energy adoption. Miners who invest in renewable-powered hosting farms or hybrid energy strategies could not only reduce costs but also enhance public image and regulatory resilience, paving the way for long-term operational viability.

From a financial perspective, mining investors must consider upfront costs, including the purchase of mining rigs, cooling infrastructure, and hosting arrangements. Equally important are the ongoing expenses—electricity bills, maintenance, mining pool fees, and potential exchange transaction charges. Calculating the break-even point for each configuration helps identify which mining machines yield the best return on investment (ROI) over time—crucial knowledge in volatile markets.

Another unpredictably dynamic variable is the global Bitcoin mining difficulty, which adjusts roughly every two weeks to keep block production steady at about every ten minutes. When more miners join the network, difficulty spikes, potentially lowering each miner’s share of rewards. Hence, machines with higher efficiency and reliability maintain an edge by producing more hashes per watt, translating into steady mining revenues irrespective of fluctuating network difficulty.

To sum up, selecting the ideal mining machine in South Korea involves a multifaceted analysis—cutting across technological specifications, energy economics, hosting solutions, and market strategies. Innovating and adapting in this layered environment demands both technical acumen and financial savvy. With Bitcoin continuing to anchor the cryptocurrency universe, backed by robust infrastructure like mining farms and exchanges, miners equipped with optimal rigs and hosting partnerships stand poised to capitalize on all that digital gold has to offer.

This article expertly navigates the complexities of selecting mining machines tailored for South Korea’s unique energy landscape, blending cost-efficiency, technological innovation, and regulatory considerations to guide both novices and experts toward optimal Bitcoin mining strategies.