As interest in cryptocurrencies continues to surge, the allure of mining has captivated individuals and enterprises alike. Even in Europe, where regulatory landscapes vary, the opportunity to invest in mining machines—from Bitcoin (BTC) to Ethereum (ETH)—is becoming increasingly attractive. For beginners stepping into the world of cryptocurrency mining, understanding the essentials of purchasing and hosting mining machines is critical for success.

First and foremost, the choice of cryptocurrency greatly influences the type of mining machine you will require. Bitcoin, the pioneer of cryptocurrencies, relies on ASIC (Application-Specific Integrated Circuit) miners which are designed specifically for its Proof of Work (PoW) consensus mechanism. Conversely, Ethereum mining, until its transition to Proof of Stake, typically utilized GPU (Graphics Processing Unit) rigs, known for their flexibility. Meanwhile, lesser-known currencies—sometimes referred to as “altcoins”—such as Dogecoin (DOGE), can often be mined using similar hardware. Each currency’s unique requirements dictate the initial investment you will need to make.

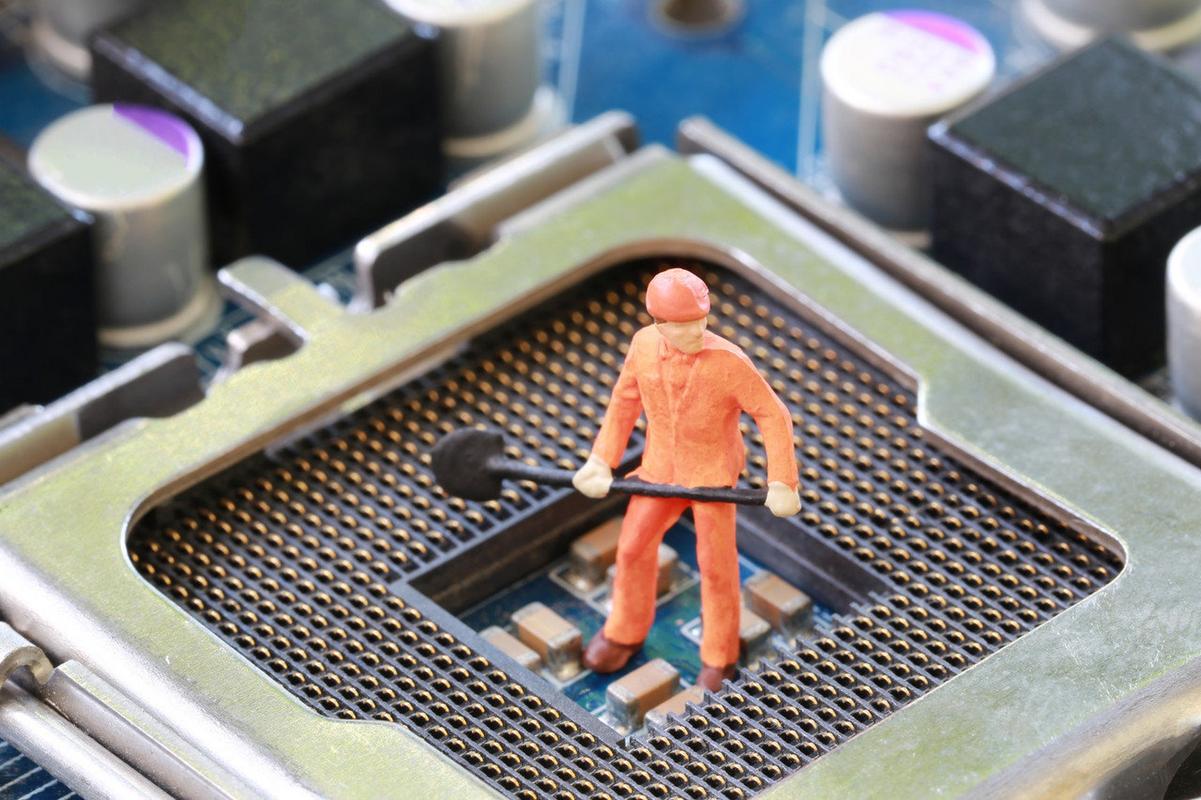

After selecting the currency and corresponding mining machine, the next essential step is setting up a mining farm or, from a practical perspective, hosting your mining rigs. Hosting can alleviate the complexities of maintaining powerful machines at home—overcoming issues like electrical demands, cooling systems, and constant monitoring. Established hosting facilities provide a reliable environment, with optimized power sources and robust cooling solutions that allow for increased uptime and efficiency of your mining operations.

Nevertheless, choosing the right hosting provider is not trivial. Look for companies that offer transparent pricing plans, robust customer support, and a proven track record within the cryptocurrency community. Furthermore, some hosting services facilitate cryptocurrency transactions, allowing seamless reinvestment of your mining earnings.

Networking remains a crucial component of your mining success. Join forums, follow experts in the field, and connect with fellow miners to gain insights and share experiences. Platforms like Reddit and specialized cryptocurrency forums brim with knowledge, ranging from machine comparisons to troubleshooting technical problems. The collaborative aspect of crypto mining can often yield unexpected tips and enhance your overall understanding of the landscape.

Another fundamental aspect of cryptocurrency mining is security. Given the prevalence of digital assets, protecting your earnings from theft or fraud is paramount. Research cold storage solutions to keep your mined cryptocurrencies safe when they are not actively traded. Additionally, selecting a reputable exchange to manage your transactions is essential; look for platforms known for their security measures and transparent policies.

It’s equally important to comprehend the taxation laws in your country regarding cryptocurrency mining. Different jurisdictions have different rules about reporting earnings, capital gains tax, and how they classify cryptos. Engage with tax professionals who understand this domain to ensure compliance and to safeguard profits from unexpected tax liabilities down the line.

As the mining landscape continues to evolve, keeping abreast of technological advancements is imperative. The introduction of new mining machines or updates to cryptocurrency protocols can significantly impact your operations. Regularly review hardware reviews and updates to remain competitive, and consider participating in beta programs or forums that discuss upcoming developments. Staying informed will not only improve your performance but may also influence your decisions on future investments.

Finally, approaching cryptocurrency mining with realistic expectations is critical. The decentralized nature of cryptocurrencies means that profitability can fluctuate due to various market conditions, energy costs, and hardware performance. Beginners should have a well-defined plan and understand the potential risks involved, rather than making hasty decisions driven by market hype.

In conclusion, embarking on the journey of cryptocurrency mining in Europe can be both exhilarating and daunting. Armed with knowledge about choosing the right machines, facilities for hosting, and understanding the mining ecosystem, you’ll be better positioned to navigate the complexities. Embrace learning and network with others in this evolving space, and let caution be your guide as you explore the lucrative world of cryptocurrency mining.

Diving into Europe’s crypto mining world? This guide smartly unpacks beginner essentials, from dodging regulatory traps to optimizing energy costs—think of it as a treasure map for avoiding costly rookie blunders in the digital gold rush. Energizing and insightful!